Student Loan Refinancing

Help employees refinance their student loans.

Student debt is costly.

Borrowers often agree to pay higher interest rates and larger monthly payments than may be feasible once they’ve started their careers.

Help your employees save with Student Loan Refinancing.

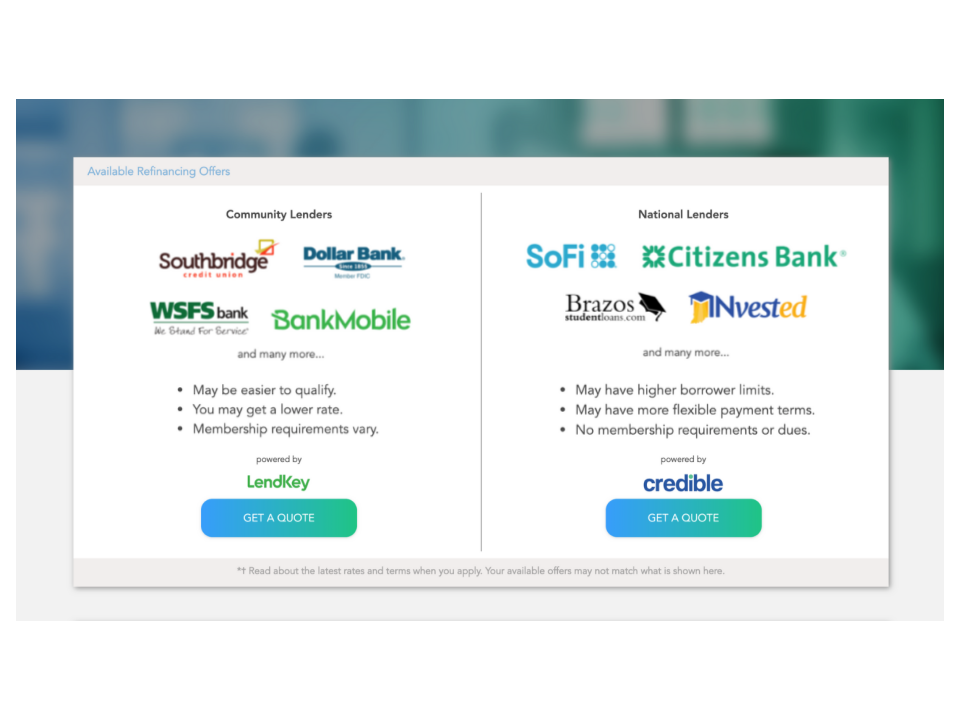

Refinancing Marketplace

We made lenders compete so borrowers get a great deal:

- Get quoted in minutes

- See rates without a hard credit pull

- Access more than 20 national and community lenders

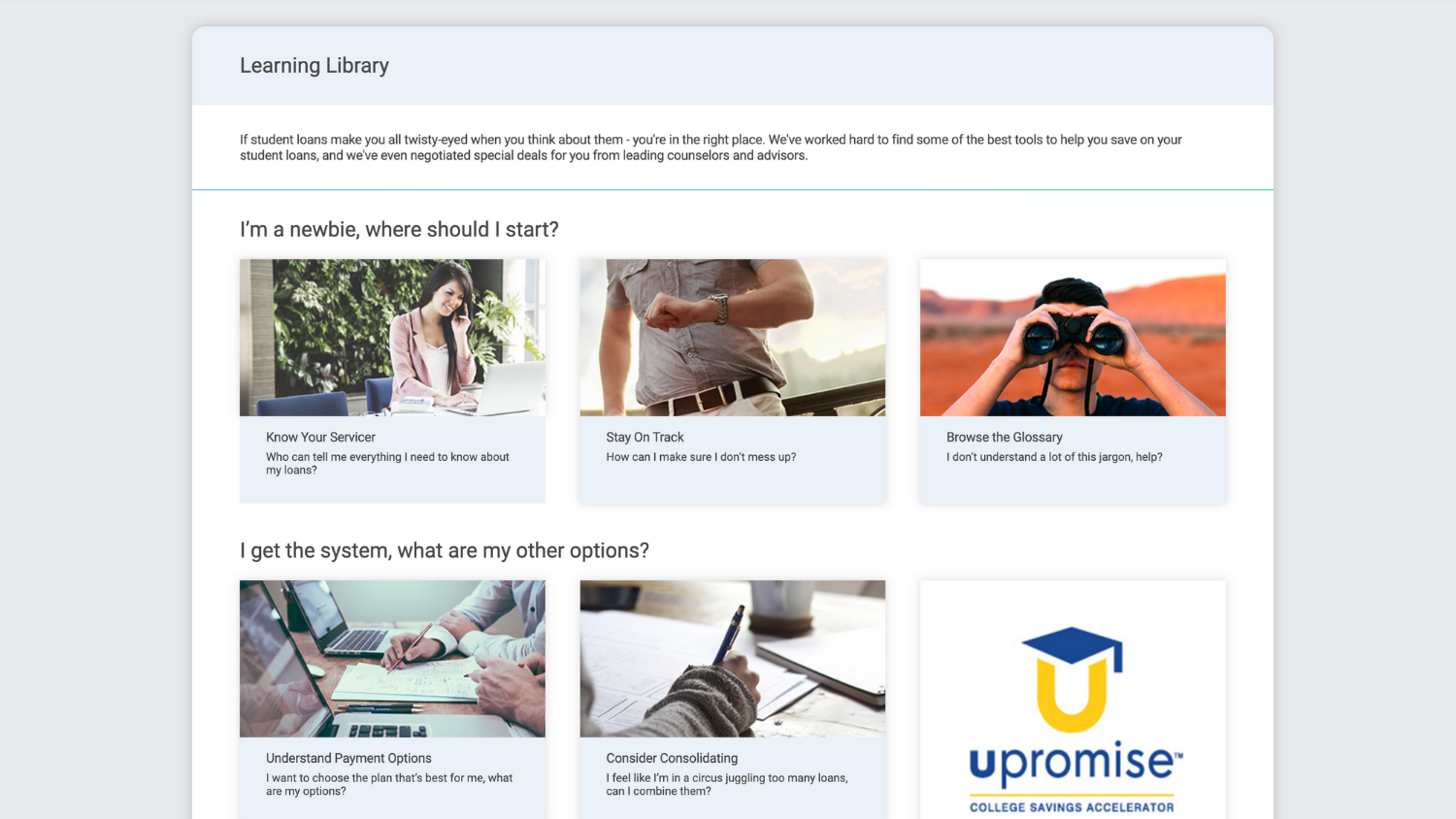

Financial Wellness Tools

Our library helps borrowers understand student debt:

- Federal and private loan guidelines

- Payment options, consolidation, and government programs

- Special offers and discounts

What is refinancing?

Student loan refinancing is the process of acquiring a new student loan at a potentially lower interest rate. If your employees choose to refinance, a new student loan lender will buy out their existing loans and provide them with a single new loan. Refinancing can help lower interest as well as monthly payments, and could potentially save them a ton of money. Peanut Butter works with multiple lenders to get you the best deal.

and many more.

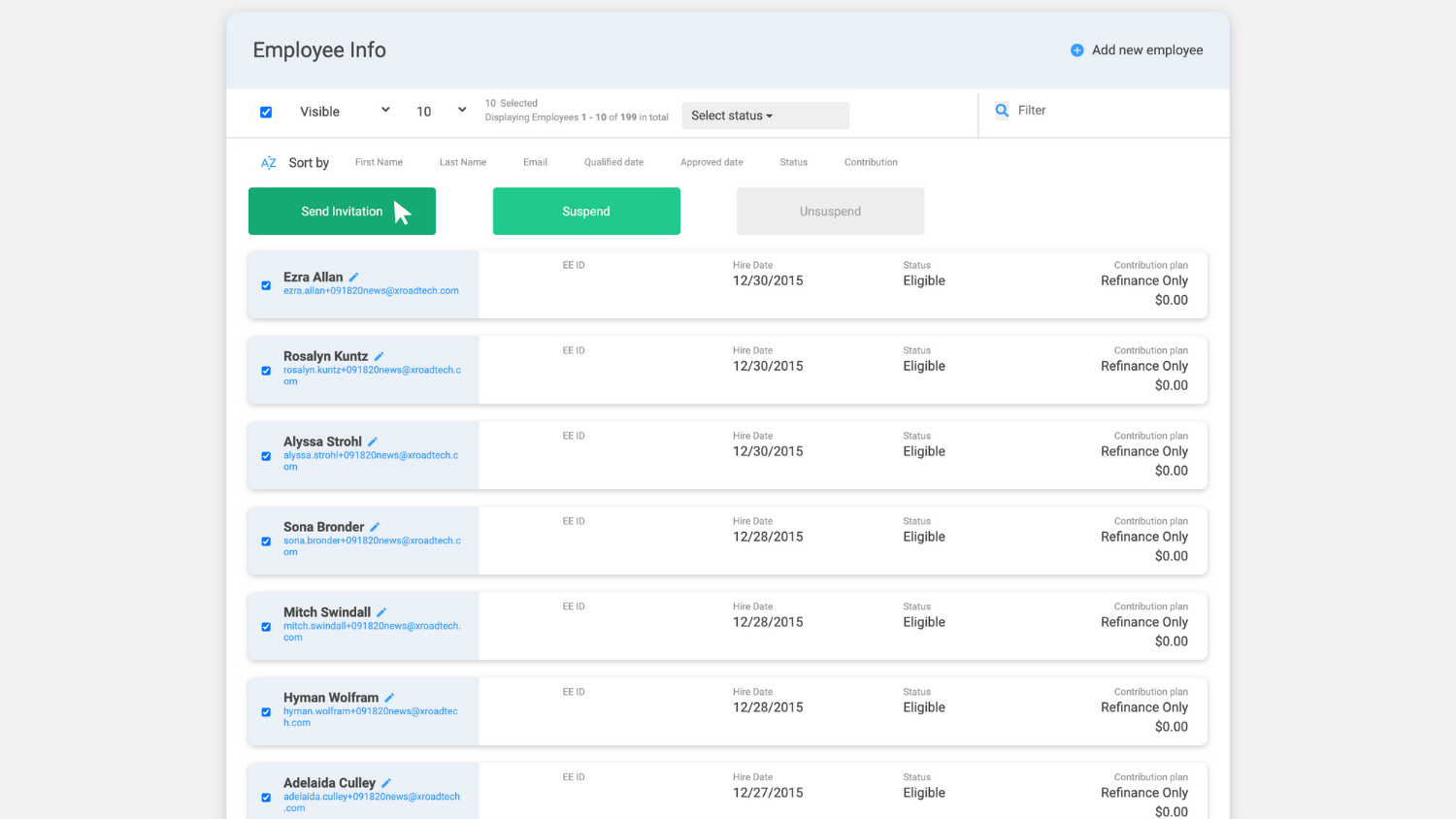

Administer your company’s program with ease.

Employer Control Panel

Kick-off program in minutes and maintain secure access to on-demand reporting.

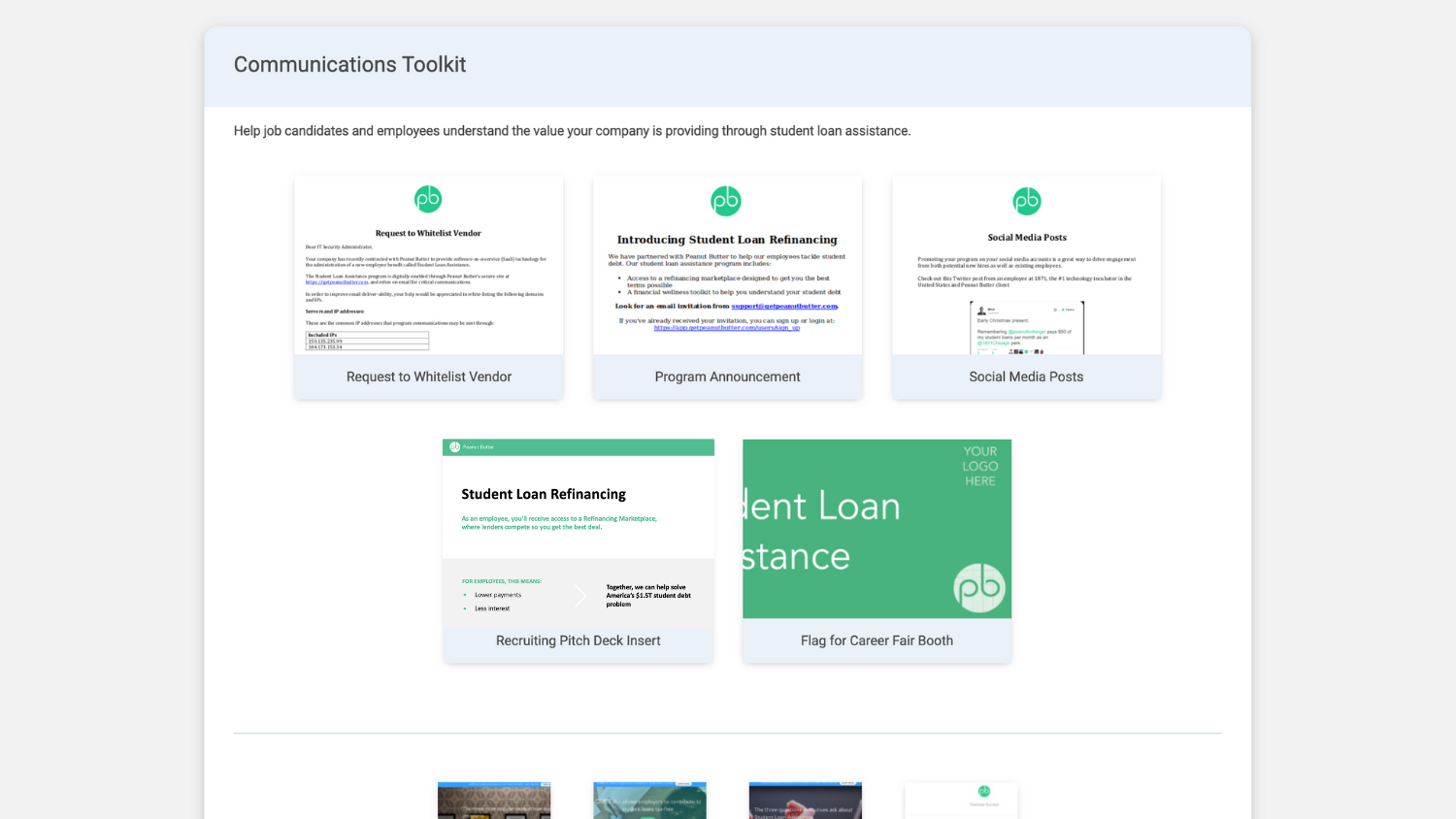

Communications Toolkit

Tried-and-trusted templates to announce your program and communicate its merits to employees.

Easily upgrade anytime.

Student Loan Resources

Give employees the tools they need to tackle their student loan debt

Student Loan Repayment

Refinancing can help employees…

- Lower payments

- Pay less interest

- Make informed decisions

And can help employers…

- Acknowledge student debt

- Make an impact

- Improve engagement

Employers & employees win with Student Loan Refinancing.

Offer employees a chance to save on their loans.