Good news: employer-sponsored student loan repayment contributions are tax deductible. An easy way to think of student loan repayment is to consider it like compensation.

That means employers can deduct their contributions as a business expense like they do with salary and wages.

It also means that employers will record Student Loan Repayment on payroll as Imputed Income.

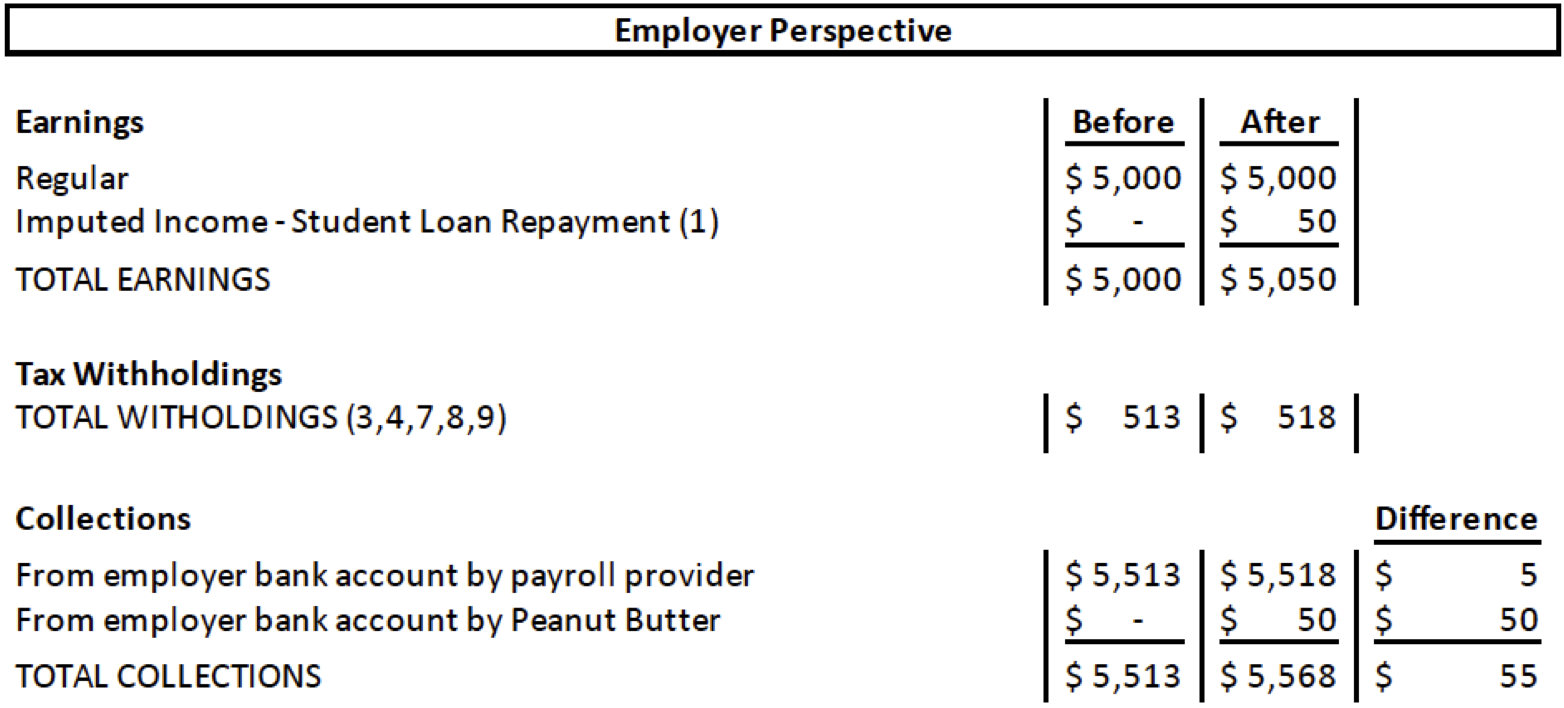

For the employer:

The following example shows the effect on monthly payroll when an employer provides $50 in Student Loan Repayment to an employee with an annualized base salary of $60,000.

In summary, an additional $55 is collected from the employer, of which $5 is withheld for taxes by the payroll provider and $50 is directed to the employee’s student loan account by Peanut Butter.

Assumptions made in calculation can be found at the end of article

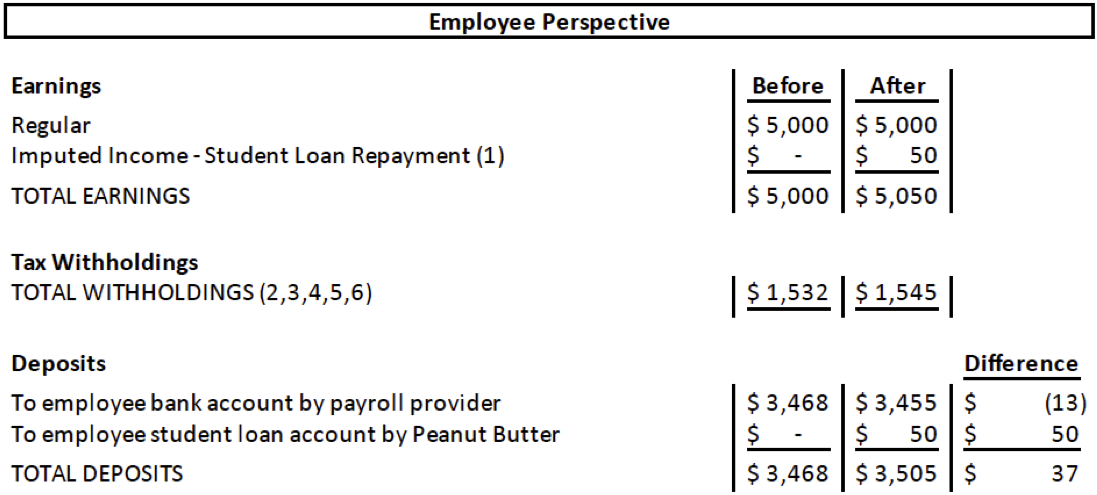

For the employee:

The following example shows the effect on monthly payroll when an employee earning $60,000 elects to participate in the company’s $50 per month Student Loan Repayment program.

In summary, the employee nets an additional $37. Although there is $13 less deposited in her bank account, she is fully withheld for taxes through the payroll provider and she receives $50 per month deposited into her student loan account that she otherwise would not have received.

Assumptions made in calculation can be found at the end of article

Our goal is to make it easy for employers to offer Student Loan Assistance. After receiving their invitation to participate in a Peanut Butter Student Loan Repayment plan, employees receive an explanation of benefits that includes a video, onscreen instructions, a sample payroll and full written terms and conditions detailing the tax impact of contributions and their responsibilities as a participant in the program.

In brief, employees that elect to participate in Student Loan Repayment agree they will be responsible for taxes, similar to accepting a raise. Should employees have any questions prior to, or after electing to participate, Peanut Butter is here to help — toll-free by phone or online.

If you have questions about what a student loan assistance program could look like at your company, please schedule time with our Client Solutions team today or click the button at the end of this post.

Here are some of the assumptions that went into the calculations used in this article.

(1) Applied only the last paycheck of each month

(2) Based on 2017 IRS tax table for a Single Taxable Income

(3) 6.2 percent applied to first $127,200 of gross earnings (cutoff not modeled)

(4) 1.45 percent, Increases to 2.35 percent above $200,000 gross earnings (increase not modeled)

(5) Varies by state, assume five percent

(6) Varies, assume 0.1 percent

(7) 0.60 percent applied to first $7,000 gross earnings (cutoff not modeled)

(8) Assume 1.0 percent, varies with employer experience

(9) Assume 1.0 percent, varies with employer experience