by David Aronson | May 17, 2017 | Insights

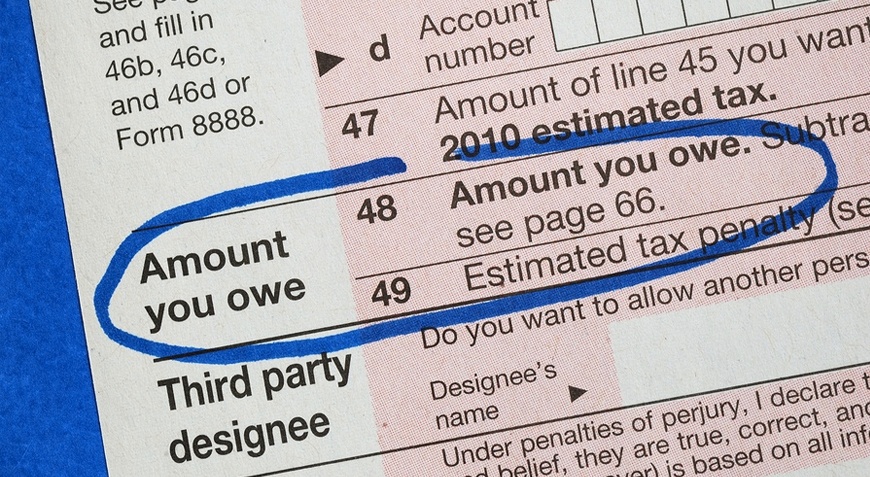

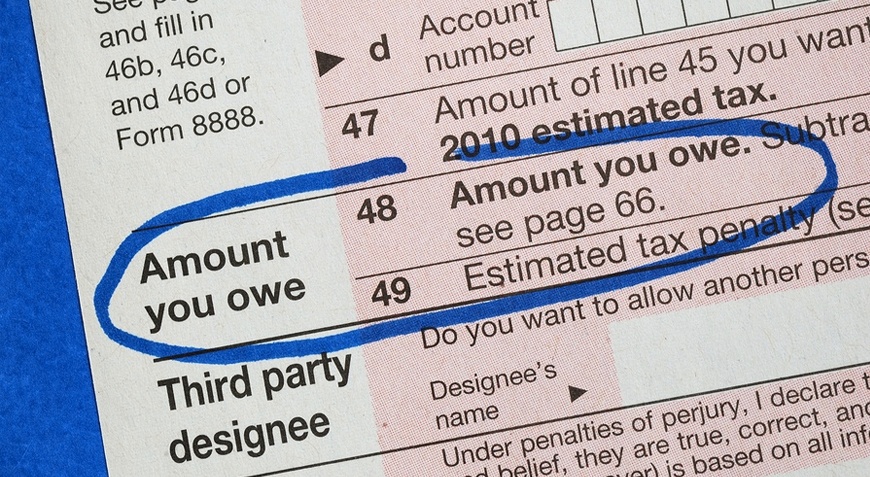

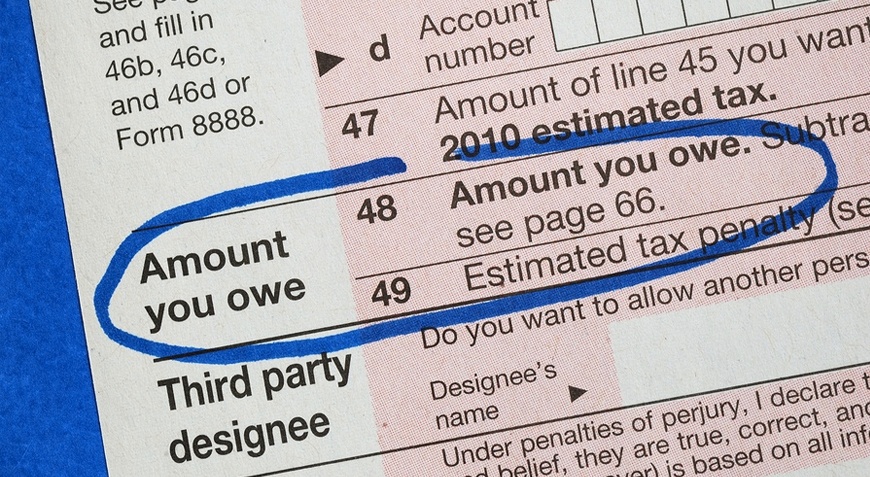

Good news: employer-sponsored student loan repayment contributions are tax deductible. An easy way to think of student loan repayment is to consider it like compensation. That means employers can deduct their contributions as a business expense like they do with...

by David Aronson | May 9, 2017 | Insights

While this may seem like a value-add service to some, the reality is that your employees don’t need this, it creates unnecessary complexity for your program and in some cases may introduce financial liability. Though technically possible, we advise employers to...

by David Aronson | May 4, 2017 | Insights

Clawback provisions are common with tuition reimbursement, so this question comes up a lot. Because of some key differences in how we administer student loan repayment, there is usually not a need to have this type of provision attached to your program. Employer...

by David Aronson | Apr 25, 2017 | Insights

This is a common question. The short answer – No. Here’s what we have learned after working with hundreds of employers. Employees recognize that not all benefits apply to all people. For example, younger workers commonly do not opt into employer health...

by David Aronson | Mar 22, 2017 | Government Relations

Peanut Butter heralds the leadership of Congressmen Patrick Meehan (Republican form Pennsylvania) and Suzan DelBene (Democrat from Washington), both members of the U.S. House of Representatives’ Ways and Means Committee, for introducing the bipartisan...

by David Aronson | Mar 21, 2017 | Press Room

We were honored to be approached by Rosie Langello, a talented master’s degree candidate at Northwestern University’s prestigious Medill School of Journalism, to talk about how we make the peanut butter 🙂 Check out the two-minute video spot on Medill...