The following is a guess post from Carolyn Kick, Marketing Manager at Launchways.

In today’s changing workforce, employers are reconsidering how they approach employee benefits. In the efforts to attract and retain top talent, companies are aiming to create more appealing benefits programs. They’re considering new, more comprehensive approaches to benefits. Even more importantly, they’re thinking about the make-up of their workforce and which benefits their employees value most.

Millennials now make up the largest portion of the U.S. workforce. Millennial-age employees have unique challenges and are looking for certain benefits from their employer. One of the concerns at top-of-mind of many millennial employees is financial wellness. In this post we’ll explore why financial wellness programs are important to your employees and how you can approach integrating financial wellness into your existing benefits program. In this post you’ll learn:

- What is financial wellness?

- What are the signs of financial wellness?

- Why is financial wellness important to your employees?

- How does financial wellness impact your workplace?

- How to help your employees become financially well

![]()

What is financial wellness?

Financial wellness is the ability to manage short-term finances while also saving for long-term goals.

Some of the signs of financial wellness include:

- Being able to pay monthly mortgage or rent

- Having money for basic necessities

- Being able to pay for healthcare costs

- Feeling of secure employment in current job

- Can afford to maintain a good standard of living

- Feeling of control over financial situation

- Saving enough for retirement

- Confident in ability to afford healthcare-related payments

- Ability to handle three months unpaid without problem if experiencing health-related financial crisis

- Low level of financial stress

It’s important to note that income and financial wellness are not entirely dependent on one-and-other. A higher income does not necessarily result in better financial wellness. Financial wellness is more related to giving your employees the tools and knowledge they need to better manage their personal finances.

Why is financial wellness important to your employees?

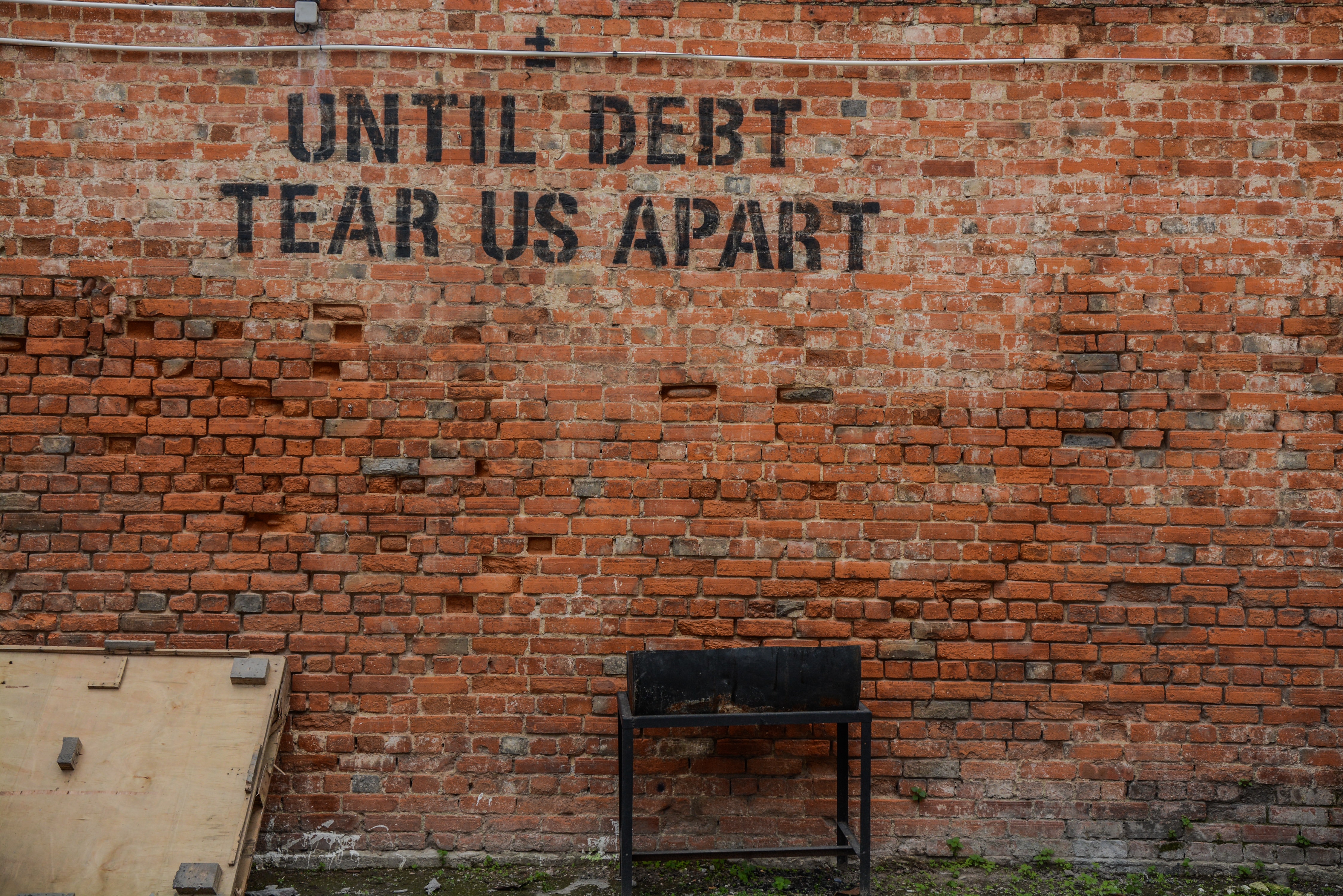

Millennials are the largest generation in the workforce and they struggle with financial wellness significantly more than prior generations. Lower starting salaries and crippling student debt are two of leading causes of poor financial health among millennials. Research indicates nearly half of millennials are not financially well:

- According to the American Institute of CPAs, 25 percent of Millennials have been late on or missed paying a bill.

- According to the Harvard University Institute of Politics, 42 percent of Millennials have student loan debt.

- According to a Harris Poll 47 percent of Millennials have less than $2,000 saved for an emergency.

Nowadays, many employers are recognizing the unique financial challenges millennials are facing and are implementing financial wellness programs to help address these challenges.

How Does Financial Wellness Impact Your Workplace?

Neglecting to invest in your workforce’s financial wellness can have an adverse impact on your bottom-line. The first concern is the financial stress your employees face on a daily basis. Research estimates that employees spend, on average, two hours a week on their own personal finances at work. This can add up to 100 hours per year per employee of lost productivity. Almost 66 percent of employers acknowledge that employees are less productive in the workplace when they are financially stressed. Companies with employees that are stressed about their personal finances suffer from:

- Lost productivity

- Higher absenteeism

- High employee turnover

On the other hand, employers than invest in their team’s financial wellness reap benefits such as:

- Higher productivity

- Happier, more motivated workforce

- Increased employee engagement

- Higher employee retention rates

- Better ability to attract and hire top talent

In fact, 38 percent of employees say that they would move to a business that prioritized their financial wellness.

How You Can Help Your Employees Become Financially Well

There are many different programs you can put in place to help your team become more financially well. Some ideas for high-impact financial wellness benefits include:

- Educate employees on their 401k options. Most millennials want to participate in a 401k program but don’t fully understand how it benefits them long-term. Furthermore, your employees may suffer from analysis-paralysis when it comes time to pick a plan. Providing educational materials and guidance to help them select the best option can help increase 401k enrollment and keep your team financially healthy.

- Provide access to financial literacy applications. Nowadays there are several mobile apps your employees can use to increase their knowledge of personal finance. Providing employees access to a financial literacy app helps empower them to take control of their personal finances.

- Market benefits packages to employees. Make sure employees fully understand the benefits available to them and help them pick the benefits that are best for themselves and their families.

- Review plan data. Try to better understand which benefits your employees are actually using. If certain programs or benefits are being underutilized, develop strategies to help employees achieve wellness in these areas.

- Offer budgeting tools or workshops. Employees appreciate tools and educational materials that help them create and manage a budget. Providing access to a budgeting app, sending out budget templates, or doing a lunch-and-learn on how to create a budget are all great options.

- Implement a student loan assistance program. Student loans are one of the biggest sources of financial stress for millennials. Research indicates that more than half of millennials are worried about being able to pay back their student loans. Companies like Peanut Butter help employers offer student loan repayments as a benefit to their employees.

- Provide access to financial planners or coaches. Many of your employees could benefit from the guidance of a financial planner or coach, but don’t have the funds to pay for one themselves. Offering a call-in hotline or access to a dedicated advisor can give employees peace of mind knowing they have a finance expert to turn to for advice.

Key Take-Aways

In today’s post, we explored why financial wellness is a top concern for today’s workforce and provided some strategies to help you improve your team’s financial wellness. Some key takeaways include:

- Financial wellness is a person’s ability to proactively manage their short-term finances and long-term savings

- Today’s workforce struggles with poor financial wellness

- A workforce with poor financial wellness can lead to absenteeism, low productivity, and high turnover

- A workplace that invests in financial wellness experiences higher employee engagement, better morale, and reduced turnover

- There are many ways you can invest in your workforce’s financial wellness including educational programs, access to apps, student loan assistance programs, and more