Financial Wellness Tools

Employees learn how to manage their student loans

Our library helps borrowers save on cost of debt.

Federal & Private Loan Guidelines

It’s important for employees to understand their loan and its requirements so there are no surprises.

- Know your servicer

- Know when you should start making payments

- Read your promissory note

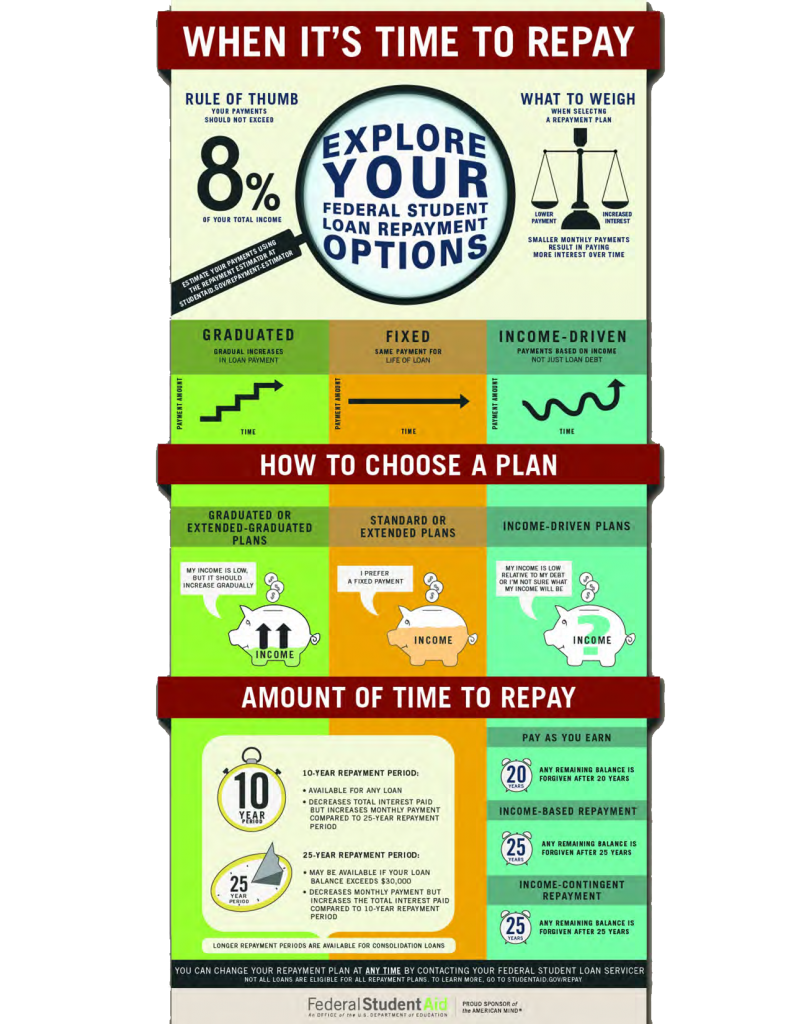

Repayment Options

Employees learn about payment options, consolidation and government programs.

- Consolidation won’t cost employees anything and they can get a fixed interest rate instead of a variable rate.

- Government programs can either assist or relieve portions of an employee’s loan.

Financial Counseling

Money Management International & other Peanut Butter partners offer student loan counseling to help employees understand their options and get their debt under control.

- Increase financial knowledge

- Create a personal action plan for success

- Take control of student loan debt

We’ve compiled resources that answer questions employees may have about their student loans.

- Online Counseling

- Debt Collector Complaints

- Loan Dispute

Employees are seeing results

“Peanut Butter has helped me realize how I can pay off my student loans faster.”

– Carrie Bush, Adtalem Global Education

Employees receive Financial Wellness Tools when their employer provides one of these solutions:

Repayment

Resources

Refinancing