by David Aronson | May 17, 2017 | Insights

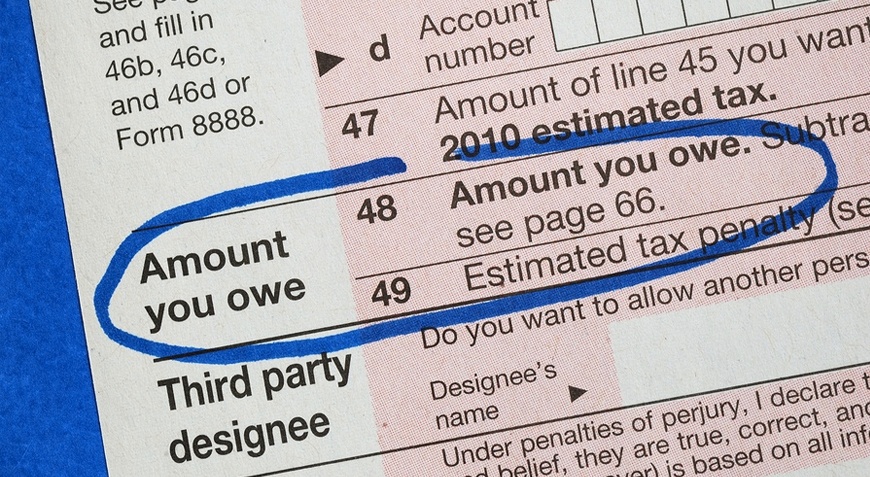

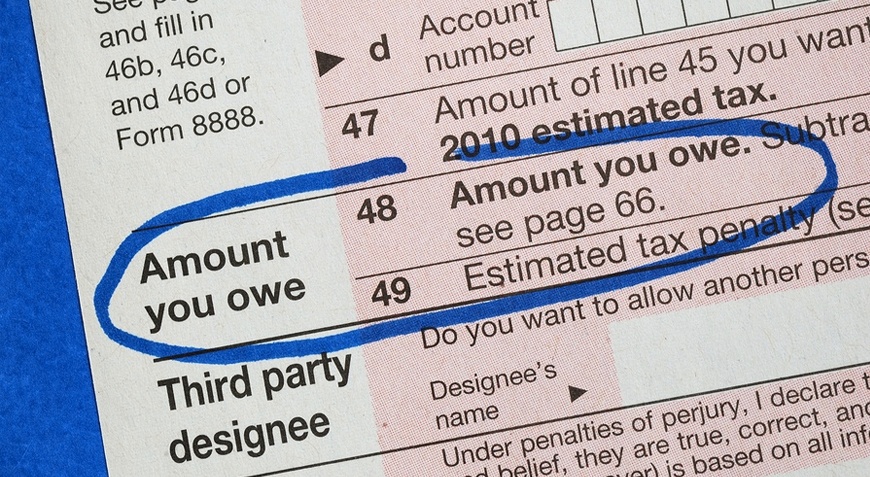

Good news: employer-sponsored student loan repayment contributions are tax deductible. An easy way to think of student loan repayment is to consider it like compensation. That means employers can deduct their contributions as a business expense like they do with...

by David Aronson | Sep 27, 2017 | Insights

Research continues to show that student debt is delaying the American Dream. For employers, the opportunity to engage Millennial talent with a meaningful benefit that addresses their interests has never been so real. The National Association of Realtors and nonprofit...

by Gabby Rouse | Dec 16, 2020

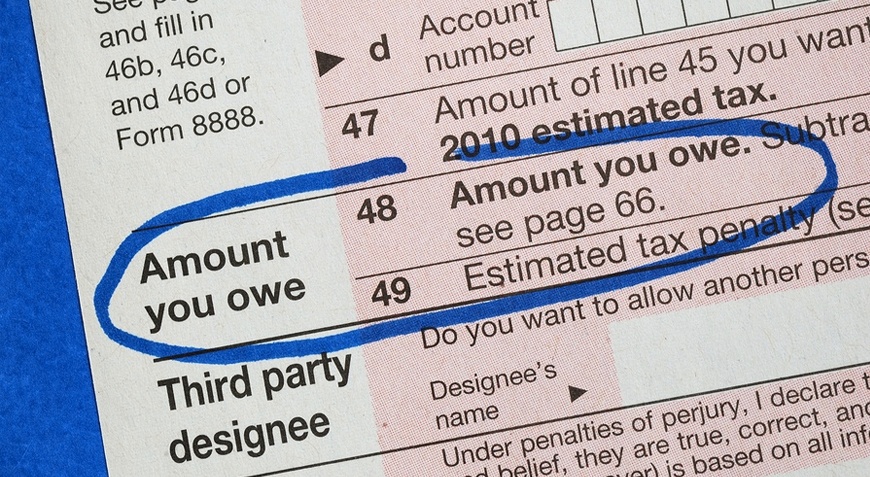

Digital Enrollment & Phone Support Employees can enroll online in minutes Pick A Plan Employees can start their digital enrollment with ease and have access to help Receive Invitation Employees receive an invitation from their employer to create their account...

by Tatum Pugh | Jan 27, 2021 | Tax-free

Here’s why now is the best time to contribute to the repayment of employee student debt. In one of his first moves in the Oval Office, President Joe Biden signed an executive order extending the payment holiday for federal student loan borrowers until at least Oct. 1,...

![[US Senate] Multiple Senators Urge IRS to Promote Educational Assistance Programs](https://www.getpeanutbutter.com/wp-content/uploads/2020/06/shutterstock_126493766-1-1080x675.jpg)

by Joe Kwasniewski | Aug 4, 2023 | Employee Benefits, Employee Engagement, Financial Wellbeing, Plan Design, Program Management, Student Loan Assistance, Student Loan Debt, Student Loan Repayment

In a recent post on the senate’s government website, senators Mark Warner (D-VA), and John Thune (R-SD) urged the IRS to promote educational assistance programs like Student Loan Repayment. The piece highlights the 2020 legislation allowing employers to offer the...

by Tatum Pugh | Apr 5, 2018 | Press Room

Peanut Butter client, Calabrio, spoke recently with Laurence Bradford of Forbes about the impact offering Student Loan Assistance has had on their business. Read below to hear what Debbie Williams, Calabrio’s Director of Human Resources, had to say below or view...

by Tatum Pugh | Nov 3, 2016 | Press Room

Tech.Co recently covered how employers offer student loan repayment as a way to attract and retain talent. Peanut Butter founder and CEO Dave Aronson is featured throughout the article, speaking to the overall debt problem in America and how employers are in a unique...

by Tatum Pugh | Jan 27, 2021 | Press Room

Peanut Butter was featured in Buffalo Business First last week, following the recent passing of legislation that gave Peanut Butter’s core service, employer-sponsored student loan repayment, a big boost. As a result of the Consolidated Appropriations Act (H.R. 133,...

by Gabby Rouse | Feb 5, 2021

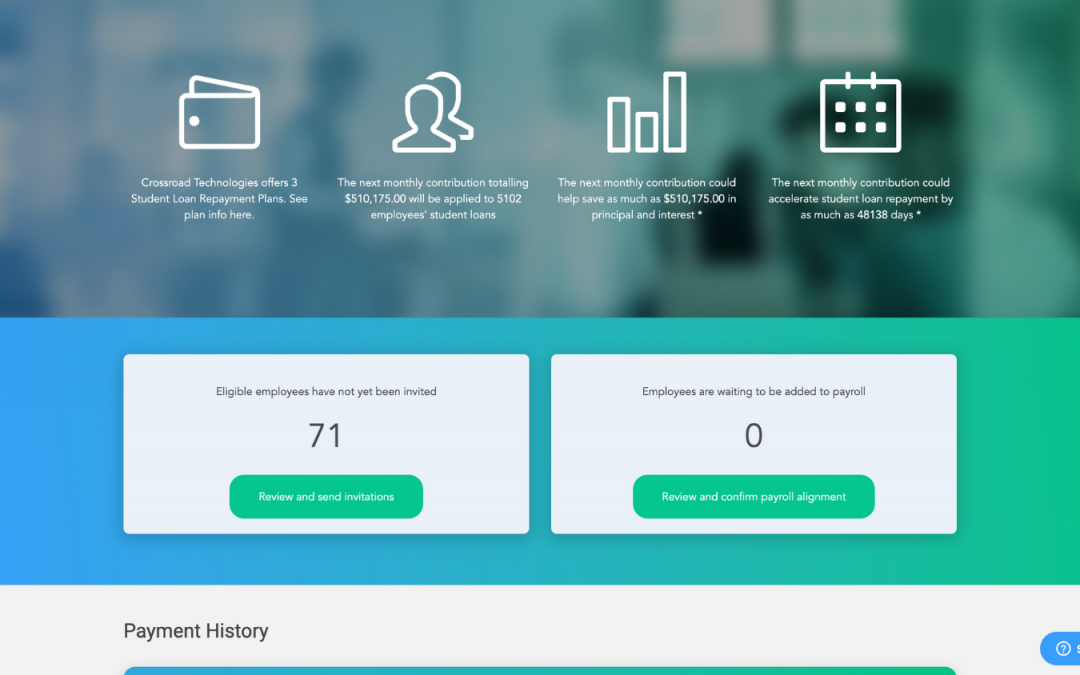

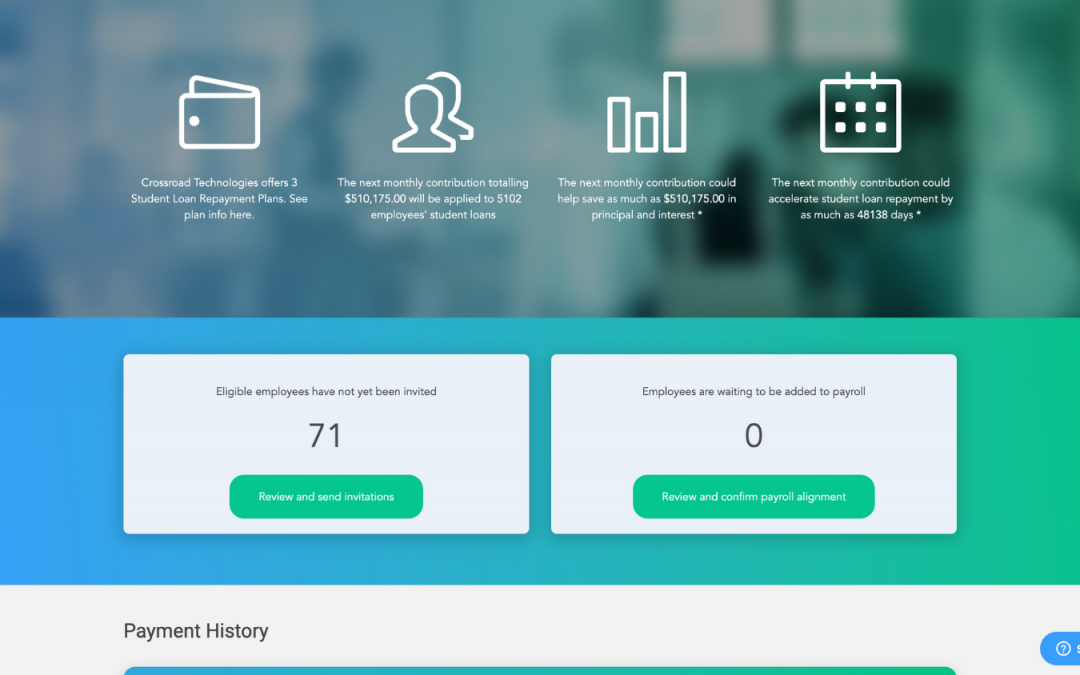

Impact Reporting Receive up-to-date data on employees’ progress Pick A Plan Impact Reporting gives employers data showcasing their impact on employees’ debt. Contribution Tracking Employers can see how much their employees have saved and could potentially...

by Joe Kwasniewski | Oct 4, 2024 | Benefits, Decisions, Differentiation, Employee Benefits, Employee Engagement, FAQ, Features, Financial Wellbeing, Human Resources, Insights, Plan Design, Program Management, Student Loan Assistance, Student Loan Repayment

In our discussions with potential clients, employers commonly ask about lifetime maximum caps on their student loan contributions for employees. Hoping to draw comparisons to other benefits. In this post, we’ll describe the best practices surrounding this concept. In...

![[US Senate] Multiple Senators Urge IRS to Promote Educational Assistance Programs](https://www.getpeanutbutter.com/wp-content/uploads/2020/06/shutterstock_126493766-1-1080x675.jpg)