What employers need to know when considering 529 Savings Plans

Smart organizations are considering Student Loan Assistance programs because they’re aware of the increasing student loan debt burden their employees face and they know it’s highly attractive for hiring and retaining talent with the right offering. If your...

Student Loan Assistance Programs With Peanut Butter

With the average student debt borrower holding $31.4K in student loans, it’s no surprise that it’s a leading cause of financial stress for employees. The good news is that employers can help by offering one of Peanut Butter’s Student Loan Assistance programs. Below is...

What’s in your toolkit? Employee Enrollment Example

All Peanut Butter clients receive an administration and communications toolkit full of resources to help them make the most of their student loan assistance program. This blog series “What’s in your toolkit?” is designed to help employers discover and understand the...![Guidelines for student loan assistance [NLR]](https://www.getpeanutbutter.com/wp-content/uploads/2020/11/coding-team-working-on-laptops-1080x675.jpg)

Guidelines for student loan assistance [NLR]

The National Law Review (NLR) recently published its guidelines to help employers steer clear of legal obstacles some have encountered with student loan repayment and tuition reimbursement programs. The three key legal considerations for student loan assistance...

Protected: Prospect Toolkit Template

Password Protected

To view this protected post, enter the password below:

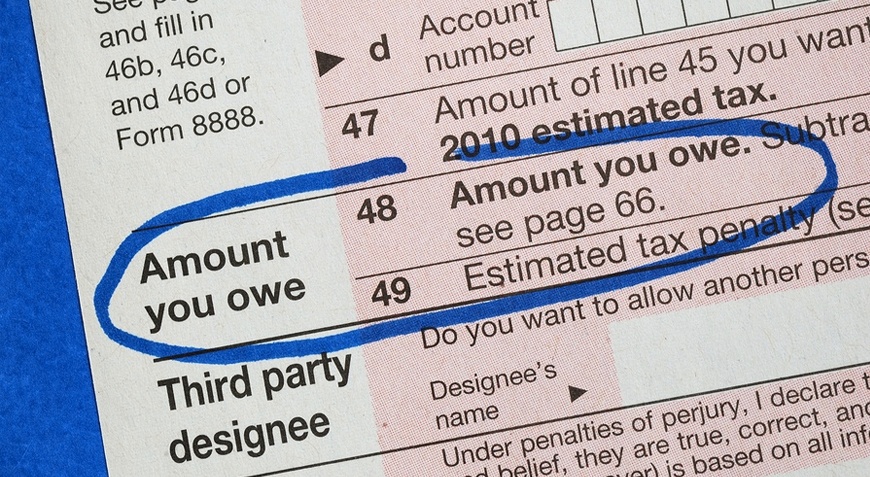

How exactly are taxes treated for student loan repayment?

Good news: employer-sponsored student loan repayment contributions are tax deductible. An easy way to think of student loan repayment is to consider it like compensation. That means employers can deduct their contributions as a business expense like they do with...

Digital Enrollment & Phone Support

Digital Enrollment & Phone Support Employees can enroll online in minutes Pick A Plan Employees can start their digital enrollment with ease and have access to help Receive Invitation Employees receive an invitation from their employer to create their account...Biden extends payment holiday on Federal student loans

Here’s why now is the best time to contribute to the repayment of employee student debt. In one of his first moves in the Oval Office, President Joe Biden signed an executive order extending the payment holiday for federal student loan borrowers until at least Oct. 1,...