Employers may now contribute to student loans tax-free

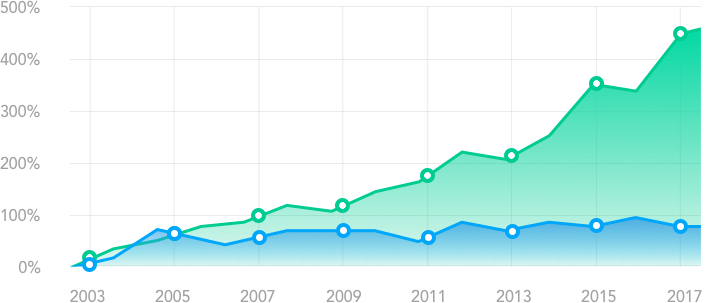

In an era of economic uncertainty, the burden of student debt becomes even more crippling for borrowers.

And the immediate need for college-educated workers becomes even more dire.

In today’s economy, Student Loan Repayment can be especially impactful for:

Employers of essential workers

Employers of the highly educated and highly indebted

-

34% of those employed in Professional Services hold student debt ($39.1K average)

-

34% of those employed in Education hold student debt ($49.3K average)

-

32% of those employed in Information & Technology hold student debt ($32.7K average)

Employers of the highly educated and highly indebted

-

34% of those employed in Professional Services hold student debt ($39.1K average)

-

34% of those employed in Education hold student debt ($49.3K average)

-

32% of those employed in Information & Technology hold student debt ($32.7K average)

Employers that have downsized and need to retain critical staff

-

26% of those employed in the U.S. Workforce hold student debt

As U.S. employers prepare to return from quarantine and ramp-up operations, it will be even more important to deliver the incentives that matter to the workers they need.

Student Loan Assistance helps employers stand-out.

Student Loan Repayment

Provide loan contributions to improve hiring and retention of talent

Student Loan Resources

Give employees the tools they need to tackle their student loan debt

Companies offering Student Loan Repayment may see…

%

faster hires

%

longer tenure

Some of the folks we’re happy to work with

Top employers like these already offer Student Loan Repayment to attract, retain and engage their valued talent.

Times are rough.

Let’s work our way forward together.

Student Loan Repayment can now be offered tax-free.

- Employers can make contributions to student loans through a Section 127 Educational Assistance Plan, and thereby…

- …exclude those contributions from employees’ gross income.

Employers may begin offering Student Loan Assistance in a few simple steps:

Setup your company’s

Student Loan Assistance program

Incorporate Student Loan Repayment

into a Section 127 plan

(optional)

Initiate enrollment online

through Peanut Butter

By offering Student Loan Repayment tax-free, employers will…

Make a greater impact on employees’ financial futures

Since State and Federal income taxes no longer need to be withheld for contributions; a tax savings of about $0.30/dollar goes directly to the employee’s bank account.

Save on payroll taxes

Since your company no longer needs to withhold FICA, FUTA, SUTA for contributions; a tax savings of about $0.10/dollar stays on the company’s balance sheet and improves earnings.

Need to comply with Section 127 requirements from the IRS

All Peanut Butter clients will receive a sample amendment to a 127 plan or a sample 127 plan document that their lawyer can review & approve.